How Blockchain technology will disrupt the Remittance Market for good

Blockchain is a digital technology which is an account-book or a record of transactions. These transactions are permanent, cannot be tempered with or hacked and since it is digital, the processing time is in seconds.

Here is how it works- If someone uses this technology to request a transaction, the request is broadcasted to a Peer to Peer network consisting of computers. The P2P network validates the transaction and the user’s status using some algorithms. Once the transaction has been verified by all the computers in the network, it is combined with other transactions to create a new block of data for the ledger. This new block is added in a way that is permanent and unalterable and the transaction completes.

![How Blockchain works [1]](/blog/images/Blockchain2.png)

Finance and banking is one industry which is being revolutionized by blockchain but there are many others which will benefit from it as well-

Blockchain and Remittance

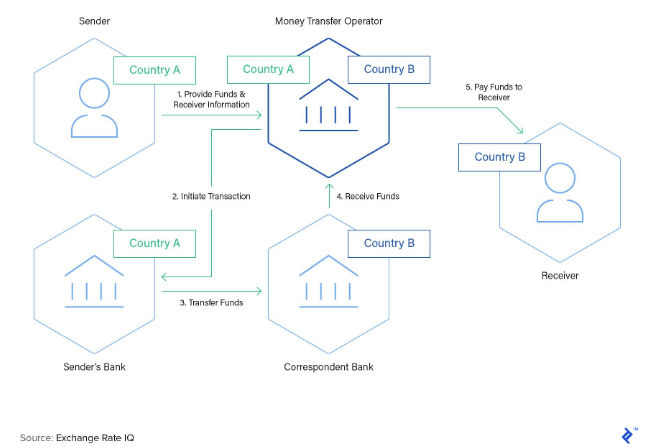

One particular industry within banking institutions that will see disruption because of blockchain is remittance. On the basis of the remittance channel, banks dominate the global remittance market which was valued at USD 508 billion in 2020 and is projected to reach USD 930.44 billion by 2026. Sending money through banks is expensive and time-consuming. They charge an average of 10.73% for the transfers. For some of the poor countries in Africa, the remittance money they receive is more than the GDP. Considering that a large percent of remit senders are poor immigrant workers sending it to their families in developing countries, this transfer rate is exorbitant. The United Nations is aiming for this cost to reduce to 3%. The rate has been falling due to increased competition and because of Money Transfer Operators but even they charge around 6% transfer rate.

![How international payments are processed[2]](/blog/images/Blockchain3.png)

Blockchain is one such technology which would help in reducing the remit rates tremendously and without any tradeoffs.

![Benefits of Blockchain[3]](/blog/images/Blockchain5.png)

![Traditional vs blockchain money transfer[4]](/blog/images/Blockchain6.png)

Because of how promising the technology is, many blockchain remittance companies have been created since 2010. Some of these companies are InstaRem which is a Singapore based digital cross border payment system that is building on RippleNet. Nigeria’s SureRemit which is a voucher based merchant system. Philippines based GCash. Besides, Tech giant Facebook and banking giant JP Morgan are working on their own digital currencies. JPM Coin will be used to handle some of the $6 trillion per day transacted between JP Morgan clients, while Facebook’s coin will be used for sending money on messaging platform WhatsApp.

Challenges and Limitations to use blockchain for remittance

The world economy still uses govt backed currencies for transactions. There might be an added fee involved to convert the various currencies to crypto and vice-versa. Also, millions of people living in developing countries still lack internet access though this is fast changing. Being fairly new and a groundbreaking technology, crypto is heavily regulated by several countries. It has a tendency to cause so much changes in all the fields mentioned earlier in the article that people are a bit skeptical about it. And its complexity doesn’t help in any way.

Summary

According to the World Bank, cutting down the transfer rate of remittance by 5% would save USD 16 billion. That is more than the GDP of half of the African nations. Many families can benefit from this money which is being wasted in the process of transfer. Blockchain can solve this problem profoundly. It would make sending money cheap, the transfer time would reduce to seconds and most importantly it is secure to the core. Among all the institutions used to transfer money, the century old Western Union is still used by most people. While banks charge an average of 10.73% transfer rate and most MTOs charge around 6%, the rate charged by Western Union is a whopping 15%! It still dominates the remittance business because people trust it. People do not hesitate to pay the extra premium to ensure the transfer would be safe. In any trade or business environment ‘trust’ lays the foundation for success. Blockchain already has this foundation built along with so many other benefits for the remittance industry to ignore.

References https://remittanceprices.worldbank.org/sites/default/files/rpw_main_report_and_annex_q42020.pdf https://medium.com/@blockdata_tech/blockchain-is-disrupting-the-700-billion-remittance-industry-b79a01a95a10 https://academy.binance.com/en/articles/blockchain-use-cases-remittance https://medium.com/r/?url=https%3A%2F%2F101blockchains.com%2Fproblems-blockchain-solve%2F [1] https://blockgeeks.com/guides/what-is-blockchain-technology/ [2] https://ripplecoinnews.com/ripple-is-ready-to-provide-remittance-solutions-to-banks/ [3] https://masterthecrypto.com/blockchain-catalyst-international-money-transfers [4] https://medium.com/@blockdata_tech/blockchain-is-disrupting-the-700-billion-remittance-industry-b79a01a95a10